Real State Development

The real estate market (residential and commercial) has not been absent from the tremendous benefits generated by Peru´s sustained economic growth.

In fact, the real estate market which in reality is part of the construction industry has been growing alongside the economy for the past fifteen years

and it probably exhibits the highest annual growth rate of any sector by far. In an emerging market, in which the middle class begins to grow exponentially

due to sound economic policies, the demand for primary services like health and education increase tremendously, as well as, the demand for having your

own house. Thus, creating medium to long term investment opportunities for real estate developers.

HOUSING DEFICIT

According to HGP Consulting Group, as of January of 2017, the housing deficit just in Lima and its metropolitan area reached around 612,464 housing units.

About 41.1% or 251,000 corresponds to the quantitative deficit, which refers toexisting homes that need to be replaced to satisfy the needs of secondary

homes that aspire to buy a house and second, homes that need to be replaced that are not suitable for living in them, or in which two or more families live

in that housing unit.

On the other hand, there is the qualitative deficit which represents around 59% or around 360,000 housing units. The qualitative deficit refersto existing

homes that are deficient in quality in terms of their construction material and access to main basic services such as drinking water, electricity and sewage.

One hundred percent of the housing deficit is concentrated in the low income districts such as San Juan de Lurigancho, Ate, San Martin de Porres, Villa

El Salvador, amongst others.

UNSATISFIED HOUSING DEMAND

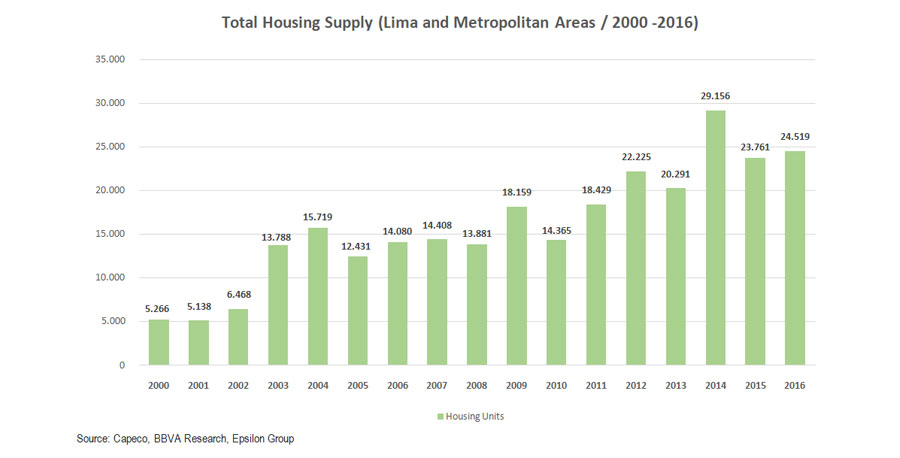

In Lima and its metropolitan area, the housing supply reached24,519 units in 2016, according to the latest study done by Capeco (Peruvian Chamber

of Construction)of the market of urban buildings in Metropolitan Lima and Callao. The graph below exhibits the upward trend of housing supply for the past

16 years.

However, this figure is not enough to cover the effective demand (those who want and can buy a home) which reaches 473,730 households.This situation results

in an unsatisfied housing demand amounting to 449,750 units.

From the perspective of housing prices, 77.2% of the total unsatisfied demand is concentrated inMiVivienda, financing program sponsored by the government

that facilitatesthe access to home loans for low to middle income families, while 21.95% correspond to Techo Propio, another financing programthat belongs

to Mi Vivienda but is aimed at families with even lower family monthly incomes than those of Mi Vivienda itself. Meanwhile, only 0.33% is located in

non-social housing.

It should be remembered that the unmet demand has increased by 3.4% compared to 2015, and the upward trend is recorded since 2011, when it was 391,434

homes.

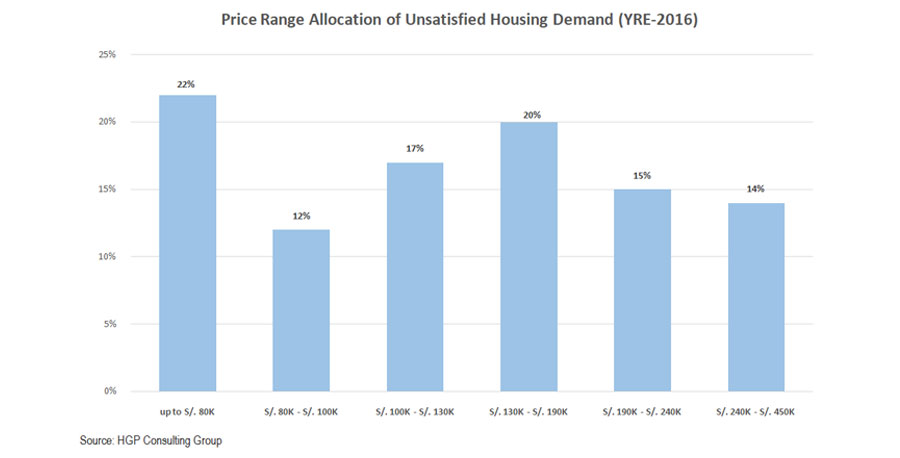

In regards to prices, 22% of the unsatisfied demand or about 99,000 households belong to a price range of up to S/. 80,000. In the price range between

S/. 80,001 and S/. 110,000 the unmet demand reaches 12%, which corresponds to an average of 56,000 households. In the same way, in the price range from

S/. 110,001 to S/. 130,000 the demand reached 17%.

Furthermore, in the price range of S/. 130,001 to S/. 190,000, the existing demand during 2016 represented 20% of the total indicated and in the range

of S/. 190,001 to S/. 240,000, the unmet demand was 15%. Finally, in the price range from S/. 240,000 to more than S/. 450,000 the unsatisfied demand

reached 14%.

From 2008 to 2012, home sales in Lima and its metropolitan areasgrew at a 15.4% compounded annual growth rate, reaching its peak at around 24,143 units

sold in 2012. This was more than 77.4% in just four years when the housing boom began its upward trend.

Although, there is not a direct correlation between the price of copper and/or commodities and the behavior of home sales in Peru, the slowdown of the

commodities super cycle alongside a deficient public investment policy from the government led by former president Humala to improve the economy,

impacted significantly on the upward trend of home sales. Demand for copper began to fall during the first quarter of 2011 (USD 4.57 per pound) and its

price kept falling for five straight years, reaching a low of USD 1.94 per pound in the 1Q of 2016. After this quarter, copper price began picking up

until today (November 2017).

Home sales took a significant downturn in 2013 alongside the end of the commodity super cycle and the slowdown of the economy, reaching only 15,934 units

sold or 51.4% below its peak back in 2012. The years ahead did not exhibit major improvements and in the past three years, sales have not exceeded the

13,000 mark (way below the all-time high back in 2012), and unfortunately, the market by year-end 2017 is not expected to go beyond that figure.

Nevertheless, the economy will pick up in 2018 and home sales should grow alongside, registering a much better sales figure than the past four years.

At the end of august 2017, the outstanding mortgage loan portfolio of the financial sector continued to exhibit important growth rates in line with the

dynamism of the economy. The total mortgage loan balance reachedS/. 39.6 billion and215,489 borrowers.With these numbers, we could conclude that the

average mortgage loan balance per borrower is approximately S/. 183,768. From 2001 to august 2017, mortgage loans for housing grew at a 14% compounded

annual growth rate.

More Ideas

Peru in your Investment Portfolio

The Peruvian economy has made significant progress in its economic performance in recent years, with dynamic rates of GDP growth and low inflation and debt.

Real State Development

The real estate market (residential and commercial) has not been absent from the tremendous benefits generated by Peru´s sustained economic growth.

Venture Capital / Funding Start Ups

On the heels of Peru’s deals and exits in 2016, there is perhaps no better time to develop the country’s budding ecosystem.