- Investment Grade economy – as of January 2017, Peru has a sovereign credit rating of BBB+ (S&P and Fitch) and A3 (Moody´s).

- The Peruvian economy is positioned for continued long term growth with an ideal demographic base.

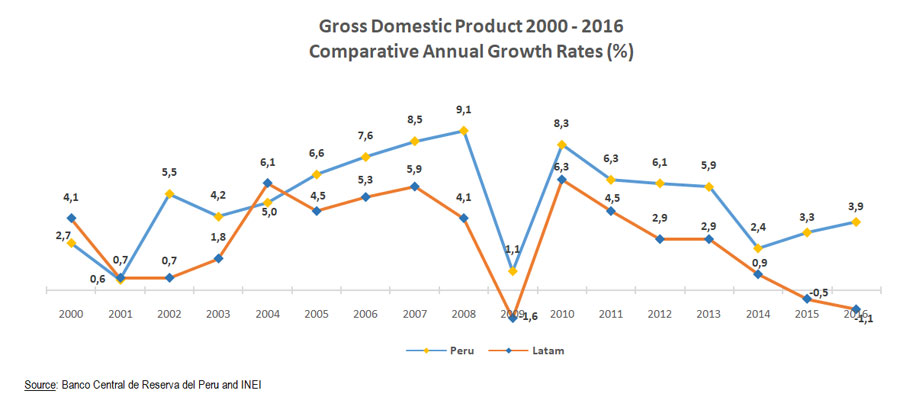

- For the past 17 years, the economy has exhibited higher growth rates than those of global developed economies.

- Reduced political, institutional and macroeconomic risk – consolidation of democracy, three decades of free elections without disruptions, economy embracing insertion into the global arena.

- Consistent flow of direct foreign investment – US $ 6.6 billion projected for YRE 2017.

- Sound economic policies have resulted in consistent economic growth and lower inflation.

- Improved country risk profile, solid international reserves – US $62.1 billion (august 2017).

- More than US $60 billion investment opportunity in infrastructure projects (2017).

| Country | S&P | Fitch | Moody's |

| Chile | AA- | A+ | Aa3 |

| Peru | BBB+ | BBB+ | A3 |

| Mexico | BBB+ | BBB+ | A3 |

| Colombia | BBB | BBB | BBa2 |

| Brazil | BB | BB | Ba2 |

| Bolivia | BB | BB- | Ba3 |

| Ecuador | B | B | B3 |

| Argentina | B- | B | B3 |

Source: Standard & Poor's, Fitch Ratings y Moody's

Sovereign Bonds Appetite

According to JP Morgan, the Peruvian Sovereign Bonds are the only ones in the region that have increased their participation in the portfolios of foreign investment funds. This went from almost 2% in June of last year to 4% in October of this year. Almost 50% of the total sovereign bonds are owned by foreign institutional investors (october 31, 2010).

The continuous appetite for fixed income securities just shows how the Peruvian economy is outperforming that of its peers in the region. Even so, foreign investment funds are buying local securities without any type of hedge that could serve as backup, exhibiting confidence in the private sector.

Latam Performance Rate of Sovereign Issuers (in %)

Macroeconomic Overview and Results

The Peruvian economy has made significant progress in its economic performance in recent years, with dynamic rates of GDP growth and low inflation and debt, while maintaining, at the same time, stable exchange rates.

MORE THAN A DECADE OF ECONOMIC GROWTH

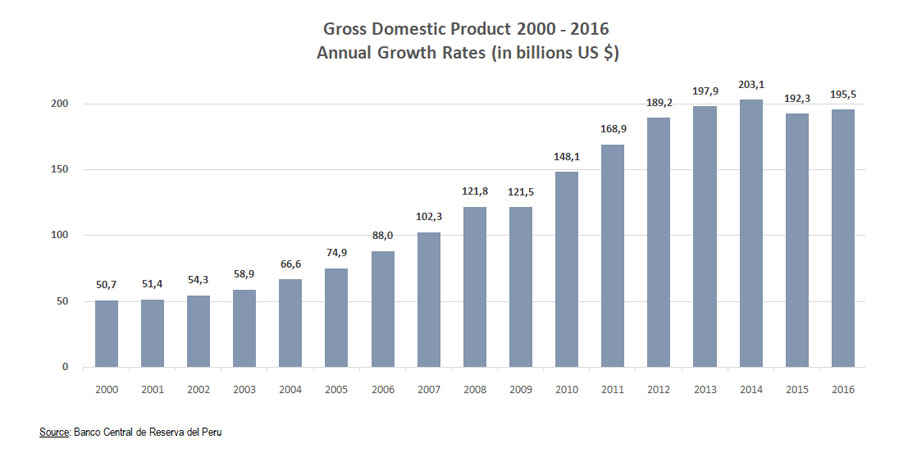

In the period 2000 -2016 , GDP increased in average by 5.1%, reaching a value greater than US$ 190 billion, by YRE2016. In this way, the Peruvian economy accumulated 16 years of consecutive growth, at rates higher than the Latin America region average.

The favorable economic forecast for Peru is based on the boost of private consumption and in announcements for both private and public investment

projects implementation.

In addition to this, is the confidence of economic agents, generated from the implementation of a responsible economic policy, which has kept continuity

through the succession of governments. According to the International Monetary Fund, Peru is a "rising star", as it is considered as an emerging market,

noted for its strong growth and low vulnerability.

STABLE INFLATION INDICATORS

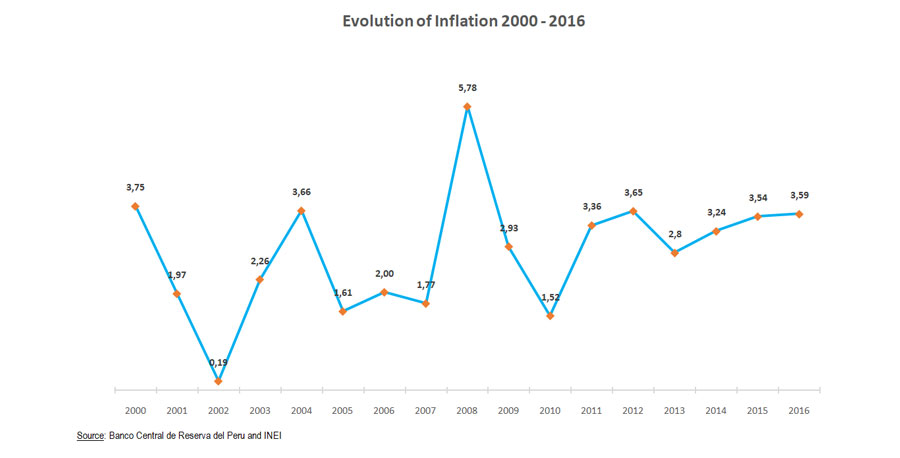

For the past fifteen years, the Peruvian economy has exhibited inflation rates in the range of 1.52% to 5.78%, averaging 2.7%, between the years 2000 to 2016.

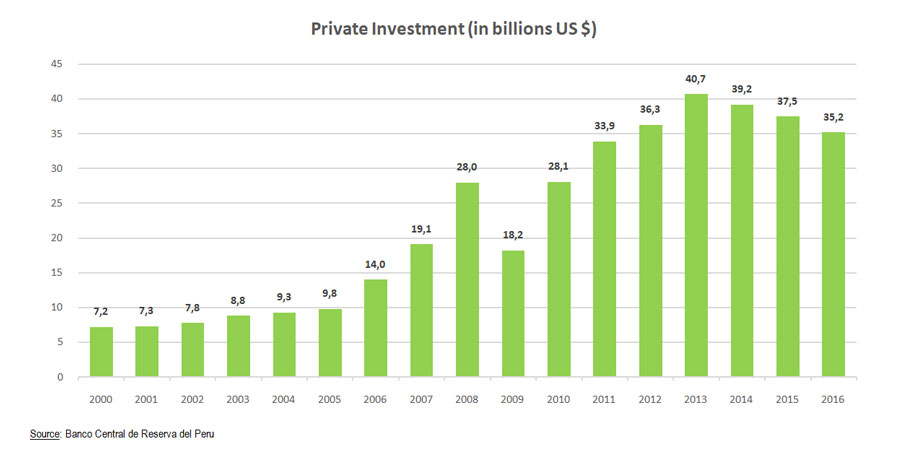

DYNAMISM OF PRIVATE INVESTMENT

The leading indicator of Peruvian growth is private investment, it has grown by 6 foldbetween the years 2000and 2013. In the period 2014 - 2016, it

exhibited a slight fall but overall, the indicator shows an upward growth trend.

In 2013, private investment grew to over U.S. $ 40 billion, due to the dynamism of the Peruvian business sector and in this year, foreign investment

accounted for 24.6% of private investment (U.S. $ 10,037 billion).

SOUNDNESS OF THE PERUVIAN ECONOMY

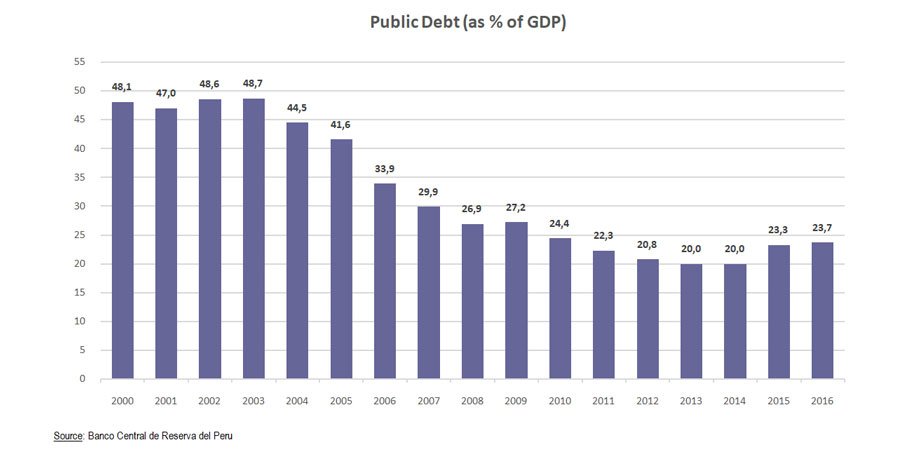

Monetary and fiscal policies of the past fifteen years have allowed Peru to record today one of the lowest debt ratios in Latin America (23.7% of GDP by YRE-2016).

Furthermore, a high level of net international reserves has been maintained, exceeding US$ 60 billion (august 2017).

Foreign Direct Investment (FDI)

FDI FLOWS ACCORDING TO THE CENTRAL RESERVE BANK OF PERU

The Central Reserve Bank of Peru (BCRP) reported a flow of US$ 6 863 million of foreign direct investment for 2016, lower by US$ 1,400 million to the amount obtained in 2015, mainly due to a scenario of low international prices (affecting the reinvestment of profits, principally in mining companies) and slow recovery of domestic demand.

TRADE INTEGRATION

Peru maintains active commercial integration policies with many countries; its long-term strategy is oriented to consolidate markets for Peruvian products,

in order to develop a competitive commercial supply that, in turn, can generate more and better jobs. In this regard, through different integration systems,

Peru has gained access to important markets, an access that is now available to local investors to use on their benefit.

Most commercial agreements entered into by Peru include, in addition to sections covering the access to new markets, other trade regulatory matters,

including investment regulations that are oriented to guarantee a stable and predictable environment for foreign investments.

It is important to note that Peru is a founding member of the World Trade Organization (WTO) and a full member of the Asia-Pacific Economic Cooperation

Forum (APEC), the latter formed by 21 economies. In the Latin American region, Peru is a member of the Andean Community (Bolivia, Colombia, Ecuador, Peru)

and, within the framework of the Latin American Integration Association (ALADI), Peru entered an Economic Complementation Agreement with MERCOSUR.

Trade Agreements

In Force

• Chile

• China

• Andean Community- CAN

• South Korea

• Costa Rica

• European Free Trade Association - EFTA

• Unites States

• Japan

• MERCOSUR

• Mexico

• Panama

• Singapore

• Thailand

• European Union

• Venezuela

• Pacific Alliance

To be in Force

• Brazil• Trans -Pacfic Partnership (TPP)

• Guatemala

• Honduras

Under Negotiation

• Trade in Services Agreement (TISA)• DOHA programme for the development

• El Salvador

• Turkey

More Ideas

Peru in your Investment Portfolio

The Peruvian economy has made significant progress in its economic performance in recent years, with dynamic rates of GDP growth and low inflation and debt.

Real State Development

The real estate market (residential and commercial) has not been absent from the tremendous benefits generated by Peru´s sustained economic growth.

Venture Capital / Funding Start Ups

On the heels of Peru’s deals and exits in 2016, there is perhaps no better time to develop the country’s budding ecosystem.