Peru Venture Capital Market Spotlight

Despite its status as one of the fastest growing economies in the world, Peru has traditionally ranked lower than its Latin American counterparts in terms

of the development of the venture capital ecosystem. In fact, until recently Peru had almost no country-dedicated VCs and between 2011-2015 consistently

captured fewer venture investment dollars than Argentina, Brazil, Chile, Colombia, and Mexico.

However, players including Telefonica Open-Future-backed Wayra, Fledge, UTEC Ventures, Angel Ventures (which obtained FOMIN backing to launch a

Pacific Alliance-focused fund), and others have become integral to the growth of the local ecosystem.

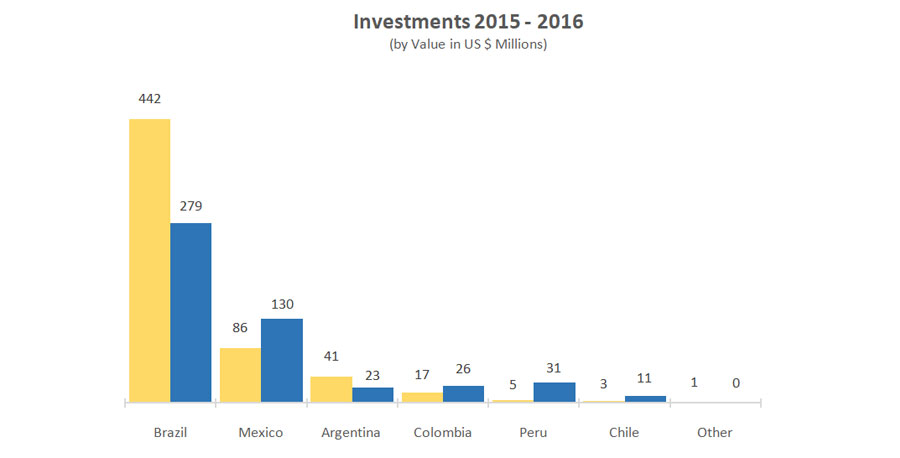

In 2016, Peru saw US$31 million distributed across venture capital deals. For the first time in five years, the country captured the highest amount

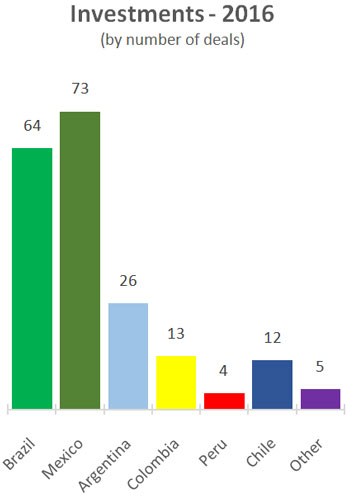

of venture investment dollars for the Andean region and the third highest in Latin America, however the number of deals remains low (4 deals in 2016,

compared to 13 in Colombia and 12 in Chile during that period). Peru also saw some notable exits: Cinepapaya(acquired by Fandango) and Busportal.pe

(acquired by Naspers-backed Redbus).

ENGAGING KEY PLAYERS IN OTHER MARKETS IS IMPORTANT

On the heels of Peru’s deals and exits in 2016, there is perhaps no better time to develop the country’s budding ecosystem. But to evolve, most players agree it will require an active role on the part of development finance institutions as well as support and engagement from other Latin American markets. For investors and industry organizations this could mean working to build a better pan-regional opportunity, including strengthening cross-border fundraising for the Andean region and breaking down barriers that restrict pan-regional VC fund investment; building bridges between various investor networks; and working to connect startups with non-traditional and smart sources of capital.

COLLABORATION IS KEY

There is an important investment trend both in the Andean region and in the rest of Latin America: global VCs are teaming up with local investors to carry out deals in the region. Even co-investments between local investors are taking off, particularly in the fintech space, which was responsible for 63% the syndicate deals in Latin America in 2016. If this trend holds true, then we may start to see a strengthening of the local investment community, not just in terms of VC activity but perhaps between the country’s growing number of angel networks as well, such as the recently launched PECAP.

The No. Of VC Deals Reached A Record High In 2016 (197)

Propelled by increased seed and early stage activity, the number of VC deals in Latin America reached a record-high, increasing from 182 in 2015 to 197 in 2016.

Brazil Was The Largest Market By Capital Invested (US$279m)

Brazil was the largest Latin American VC market in 2016 in terms of capital invested, with US$279m, or 56% of the regional total, deployed through 64 transactions.

Mexico Recorded The Highest No. Of VC Deals In The Region (73)

Overall Mexico recorded the highest number of VC deals in Latin America across all investment stages (seed, early, and expansion) for the first time, increasing from 48 in 2015 to 73 in 2016.

More Ideas

Peru in your Investment Portfolio

The Peruvian economy has made significant progress in its economic performance in recent years, with dynamic rates of GDP growth and low inflation and debt.

Real State Development

The real estate market (residential and commercial) has not been absent from the tremendous benefits generated by Peru´s sustained economic growth.

Venture Capital / Funding Start Ups

On the heels of Peru’s deals and exits in 2016, there is perhaps no better time to develop the country’s budding ecosystem.